Transform Financial Management with Automation

Designed for PMS, AIFs & MFs | Automate | Ensure Compliance | Scale Efficiently

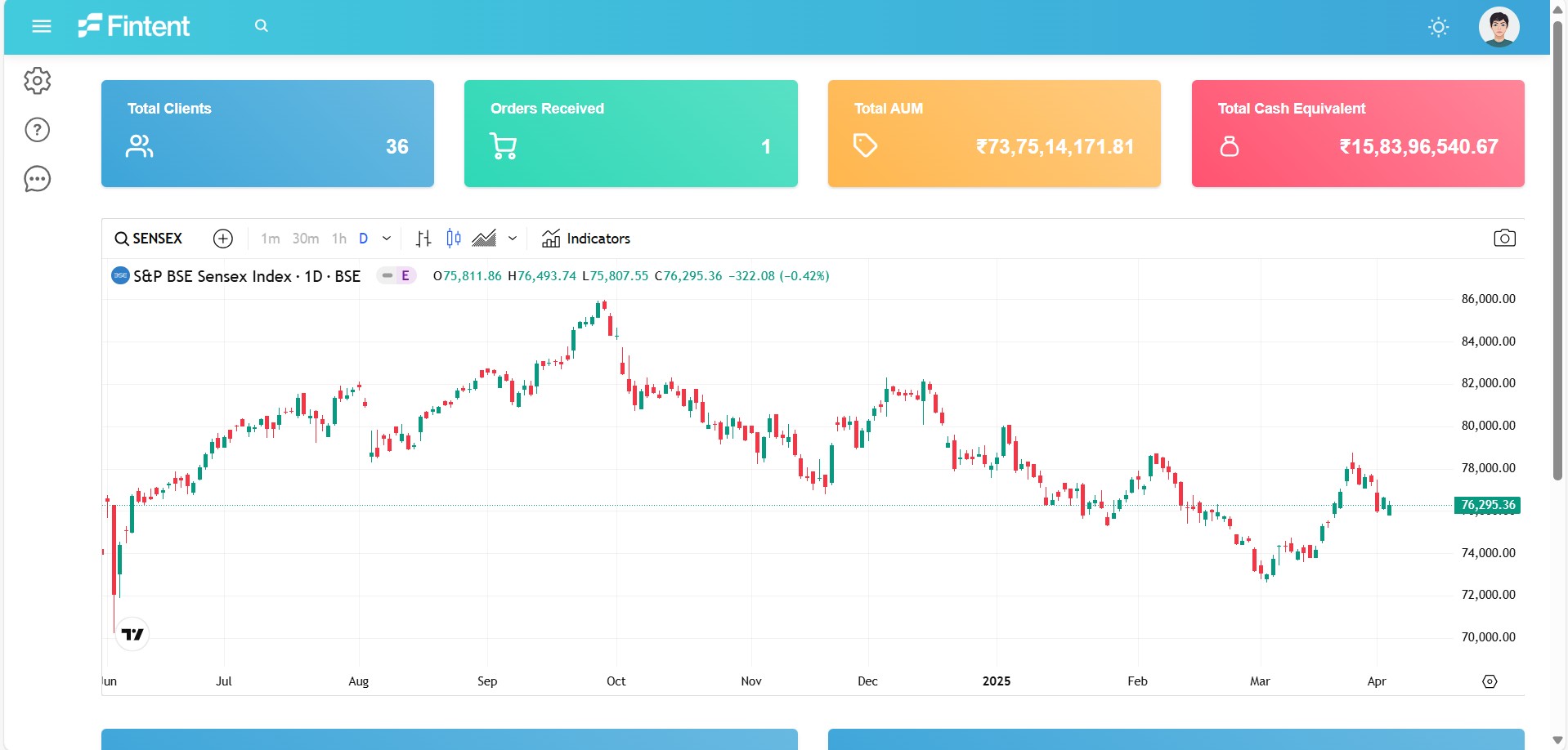

About Fintent

Fintent empowers PMS, AIFs, and MFs with smart automation to reduce manual work and enhance efficiency. Designed by industry veterans with 40+ years of experience, our cost-effective platform helps firms cut operational costs by up to 80%.

Ready to Transform Your Financial Operations?

Why Choose Fintent?

Fintent offers a modern, efficient solution for PMS, AIFs, and MFs—designed to outperform traditional systems.

- Cost-Effective – Significantly lower operational costs

- Automated Workflows – Reduce manual work and errors

- SEBI Compliance Ready – Built-in regulatory support

- 24/7 Support – Reliable assistance anytime

Achieve up to 80% reduction in operational costs with a scalable and secure platform.

Join 100+ investment firms optimizing their workflow.

Hear From Our Clients

“A Game-Changer for Portfolio Management!”

Fintent has transformed the way we manage our PMS operations. The platform’s seamless order management, real-time client updates, and compliance automation have saved us countless hours and enhanced our accuracy. Highly recommended for any asset management company looking to scale efficiently.

– Rahul Mehta

“Reliable, Cost-Effective, and User-Friendly”

Switching to Fintent was one of our best decisions. Their OMS and Tax Calculation Systems are intuitive, fast, and built with the user in mind. The platform made complex tasks simple and provided complete visibility across trades, reconciliations, and tax calculations.

– Priya Shah

“Exceptional Support and Scalable Solutions”

The Fintent team truly understands the needs of PMS, AIFs, and Mutual Funds. From client onboarding to daily operations, everything feels effortless. Their customer support is outstanding — prompt, knowledgeable, and always ready to help.

– Amit Verma

Frequently Asked Questions (FAQ)

What is Fintent and how can it help my investment management firm?

Fintent is a cost-effective digital platform designed for Portfolio Management Services (PMS), Alternative Investment Funds (AIFs), and Mutual Funds (MFs). We help firms automate order management, fund accounting, and tax calculations, simplifying operations, ensuring compliance, and improving overall efficiency.

Which asset classes does Fintent’s Order Management System (OMS) support?

Our OMS supports a wide range of asset classes including Equities, Preference Shares, Mutual Funds, Fixed Income Securities (FIS), Money Market Instruments (MM), Bank Deposits, as well as Equity and Debt Derivatives.

How does Fintent ensure regulatory compliance and risk management?

Fintent’s platform includes built-in compliance tools such as security freeze, sector freeze, client freeze, and amount freeze features. It also generates internal and regulatory compliance reports, ensuring all actions adhere to industry standards and client mandates.

Can Fintent integrate with multiple brokers, custodians, and fund accountants?

Yes, Fintent is designed for seamless multi-broker and multi-custody integration. Our platform supports custom broker allocation, dynamic cash position management, and automatic communication with brokers and custodians through standard STP (Straight Through Processing) methods.

Is the Fintent platform customizable to suit my firm’s specific needs?

Absolutely. Fintent allows firms to customize modules like reporting formats, broker allocation logic, sector restrictions, and risk parameters. We also offer client-specific customizations in the reporting and tax modules based on operational requirements.

What reports can Fintent generate for portfolio managers and clients?

Fintent generates a wide range of reports including Trade Reports, Client Investment Reports, Reconciliation Reports, Performance Reports, Taxation Reports, and customized Fund Fact Sheets. These reports offer real-time insights and compliance-ready documentation.

How does Fintent’s Tax Calculation System simplify tax reporting for AIFs and PMS?

Our Tax Calculation System automates complex tax processes like capital gains computation, distribution waterfalls, and client-level tax reports. It fetches real-time data directly from exchanges, ensuring accurate, audit-ready, and regulator-compliant tax reporting.

What kind of support and onboarding assistance does Fintent provide?

We offer comprehensive onboarding, training, and dedicated account management. Our support team ensures a smooth transition, customization assistance, and ongoing support via email, calls, and remote sessions to help you maximize the platform’s benefits.

Discover how Fintent can streamline your workflows, ensure compliance, and reduce operational costs.

Experience the difference—book your personalized demo today.