ETF Module

Exchange-Traded Funds (ETFs) have become a cornerstone of modern investment strategies due to their liquidity, cost-efficiency, and diversification benefits. However, managing ETFs involves complex trade order accounting, compliance tracking, and real-time NAV calculations. Fintent’s ETF Module streamlines ETF trade processing, ensuring automated order execution, accurate NAV tracking, invoice generation, and seamless integration with custodians and fund accountants.

Challenges in Traditional ETF Management

- Tracking Intra-Day NAV for ETFs

● ETFs require real-time NAV computation based on market fluctuations and corporate actions. - Trade Execution & Custodian Reconciliation

● Fund managers must execute ETF orders seamlessly while ensuring reconciliation with custodians and authorized participants (APs). - Corporate Actions & Portfolio Adjustments

● Handling ETF-related dividends, splits, and rebalancing manually increases operational risks.

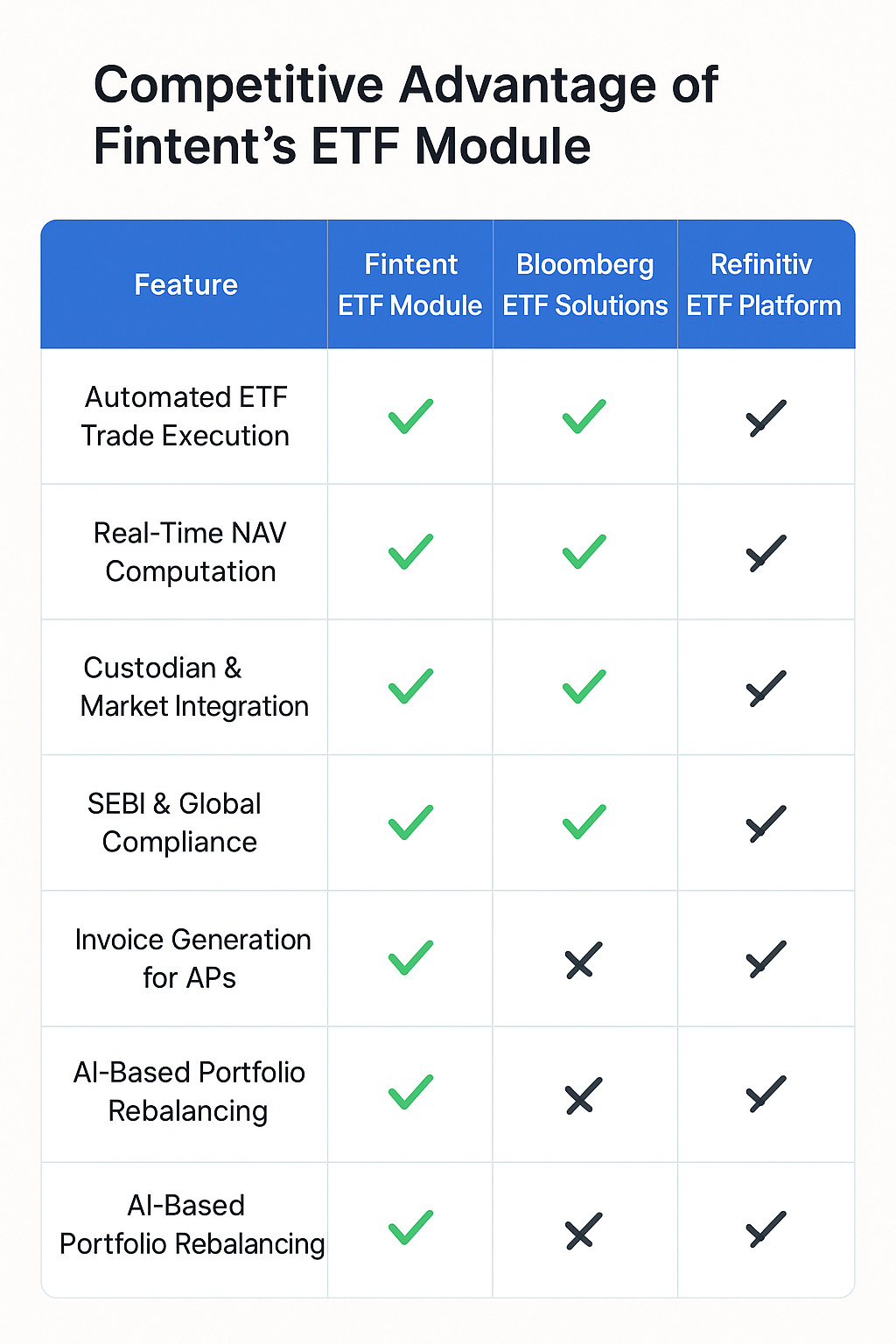

Key Features of Fintent’s ETF Module

Automated Trade Order Processing

Real-Time NAV Tracking

Invoice Generation for Authorized Participants (APs)

Custodian & Exchange Integration

Regulatory Compliance & Reporting

Technical Workflow of Fintent’s ETF Module

Step 1: ETF Basket Creation & Order Placement

● Fund managers create ETF orders based on model portfolios.

● Orders are transmitted to exchanges and APs.

Step 2: Trade Execution & Custodian Confirmation

● Automated trade execution with real-time price validation.

● Trade confirmations received from custodians.

Step 3: NAV Computation & Portfolio Rebalancing

● Adjusts NAV dynamically based on market fluctuations.

● Auto-rebalances ETFs based on benchmark tracking.

Step 4: Compliance Reporting & Invoice Generation

● Automated SEBI-compliant ETF tax and regulatory reporting.

● Generates invoices for ETF creations and redemptions.

Regulatory Compliance & Security

- SEBI & Market Regulations Compliance

● Fully compliant with SEBI ETF guidelines.

● Automatic generation of required ETF reports and filings. - Secure Transaction & Data Handling

● End-to-end encryption for ETF trade data.

● Role-based access control (RBAC) for secure fund transactions.

Future Enhancements & Roadmap

- AI-Powered ETF Portfolio Rebalancing

● AI-driven recommendations for optimizing ETF weightage & performance. - Blockchain-Based ETF Settlement Processing

● Enhancing transparency & efficiency in ETF transactions using blockchain

Conclusion

Fintent’s ETF Module revolutionizes ETF management by automating order processing, ensuring real-time NAV tracking, and enhancing compliance reporting.