Tax Calculation System

Taxation plays a critical role in investment fund management, impacting both fund managers and investors. Ensuring accurate, real-time tax calculations for various asset classes is crucial for compliance and efficiency. Fintent’s Tax Calculation System is designed to automate tax computations for Alternative Investment Funds (AIFs) Category III, Portfolio Management Services (PMS), and Asset Management Companies (AMCs), ensuring accurate tax calculations, investor-level allocations, and seamless regulatory reporting

Challenges in Traditional Tax Accounting

- Complexity in Capital Gains Calculations

● Different asset classes attract varying tax rates and structures, making manual calculations prone to errors. - High Compliance Burden

● Investment firms must comply with SEBI, GST regulations, Securities Transaction Tax (STT), and capital gains tax rules, increasing administrative overhead. - Reconciliation & Discrepancies

● Manual reconciliation of trades, tax deductions, and investor-wise distributions often results in mismatches, delaying tax filings.

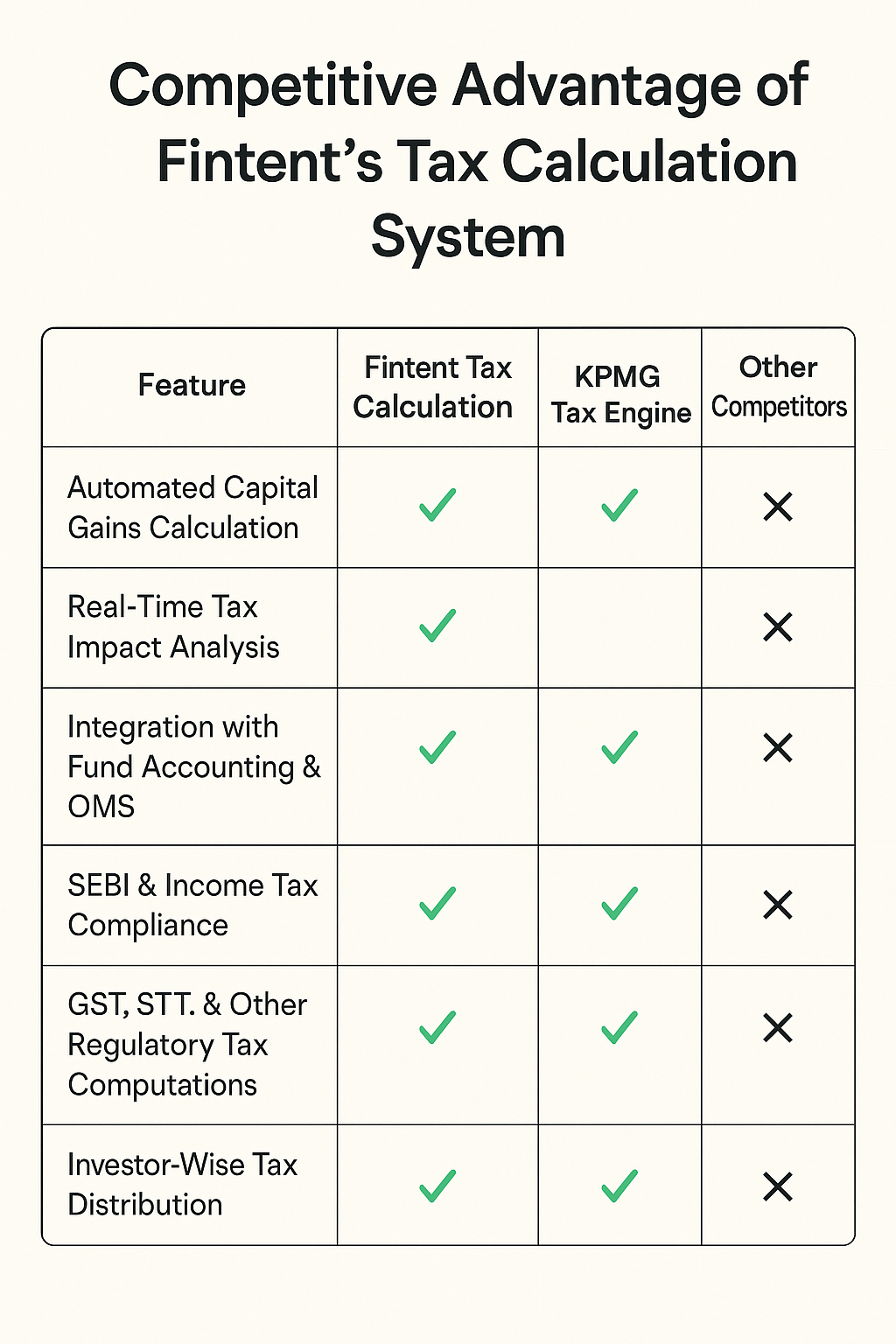

Key Features of Fintent’s Tax Calculation System

Automated Capital Gains Computation

Real-Time Tax Impact Analysis

Investor-Wise Tax Distribution Waterfall

Audit-Ready Tax Reporting

Integration with Fund Accounting & OMS

GST, STT, & Other Regulatory Tax Calculations

Technical Workflow of Fintent’s Tax Calculation System

Step 1: Trade Data Extraction

● Captures executed trade details from the OMS and Fund Accounting System.

● Fetches real-time prices for accurate capital gains computation.

Step 2: Asset-Wise Tax Computation

● Segregates trades based on short-term and long-term tax classifications.

● Applies tax slab rates as per SEBI & Income Tax Act provisions.

Step 3: Investor Allocation & Tax Waterfall Distribution

● Allocates tax liabilities based on investor ownership structures.

● Distributes taxes among investors in compliance with fund mandates.

Step 4: Compliance Validation & Reporting

● Ensures SEBI, Income Tax Act, and regulatory compliance.

● Generates tax reports for filing and audit purposes.

Regulatory Compliance & Security

- SEBI & Income Tax Compliance

● Fully compliant with SEBI AIF & PMS tax regulations.

● Auto-generated capital gains tax, GST, and STT reports.

- Secure Tax Data Handling

● End-to-end encryption for sensitive tax information.

● Role-based access control for tax reporting and filings.

Future Enhancements & Roadmap

- AI-Powered Tax Optimization

● AI-driven tax planning to reduce investor tax liabilities. - Blockchain-Based Tax Ledger for Audit Transparency

● Ensuring tamper-proof, blockchain-based tax records.

Conclusion

Fintent’s Tax Calculation System revolutionizes taxation for AIFs, PMS, and AMCs, ensuring accuracy, compliance, and automation