Order Management System

In today’s fast-paced financial landscape, institutions dealing with investment portfolios, including Portfolio Management Services (PMS), Alternative Investment Funds (AIFs), and Asset Management Companies (AMCs), require a streamlined and automated approach to handling orders. A robust Order Management System (OMS) is the backbone of efficient trade execution, ensuring compliance, accuracy, and real-time processing.

Fintent’s OMS is a cutting-edge solution that eliminates manual inefficiencies and enables seamless integration with brokers, custodians, and fund accountants. With the ability to handle multiple asset classes, automated trade allocations, risk management, and real-time portfolio monitoring, the OMS provides a single platform for managing the entire order lifecycle.

Industry Challenges Before OMS Implementation

- Manual Trade Execution and Inefficiencies

Traditionally, fund managers and traders executed orders manually, leading to human errors, delays, and inefficiencies. This often resulted in price slippage, missed investment opportunities, and reconciliation issues. - Lack of Transparency in Order Placements

Investment firms lacked real-time visibility into order status, allocations, and trade execution, making it difficult to track orders across different funds and strategies. - Compliance and Regulatory Risks

SEBI, RBI, and international financial regulators require firms to adhere to strict trade execution and reporting norms. Manual processes made compliance reporting tedious and error-prone. - Data Inconsistencies and Reconciliation Issues

Investment firms dealing with multiple brokers and custodians struggled with discrepancies in trade execution, price mismatches, and settlement errors.

Key Features of Fintent’s OMS

Seamless Order Execution

Multi-Asset Class Support

Automated Trade Allocation & Reconciliation

Broker and Custodian Integration

Real-Time Price Fetching and Trade Validation

Risk Management & Compliance Monitoring

Bulk Trading & Dynamic Portfolio Adjustments

Conclusion

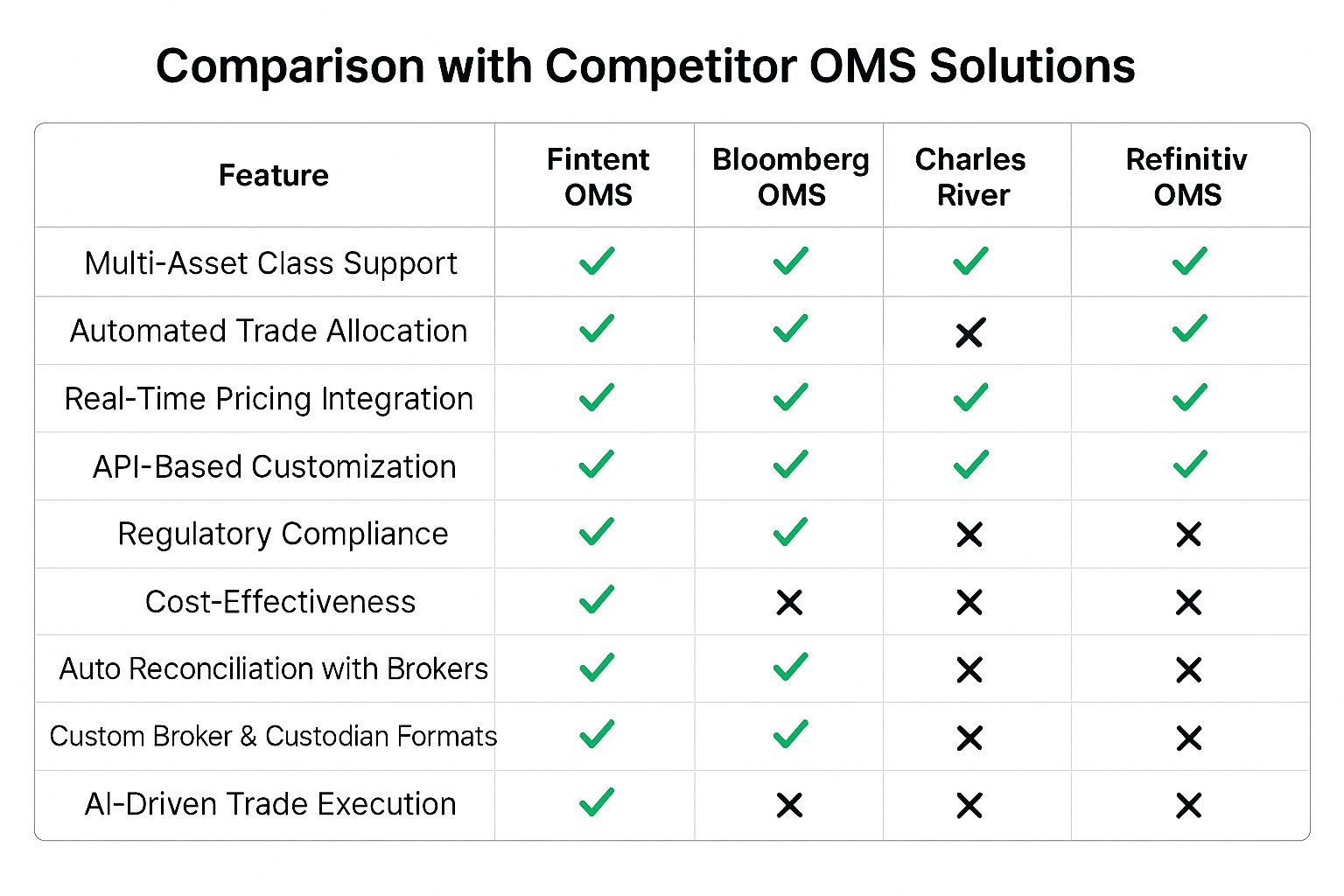

Fintent’s Order Management System (OMS) provides a comprehensive solution for PMS, AIFs, and AMCs, ensuring seamless order execution, compliance, and real-time monitoring. With advanced automation, real-time pricing, and integrated risk management, Fintent’s OMS offers a powerful alternative to traditional and high-cost global OMS platforms.